- Economy

Startups, Lombardy accounts for half of Italy's deals

Total capital raised declined to €1.1 billion

Italy’s startup ecosystem saw an increase in deal volume but a decrease in capital raised. In 2025, 204 funding rounds closed, up 10.5% from the previous year. Total investment reached €1.1 billion, a 22% decrease from €1.4 billion in 2024. Mega-deals accounted for nearly 40% of total funding. These findings are from a report presented at SIOS25 Winter, the tenth anniversary of the StartupItalia Open Summit at Palazzo Mezzanotte.

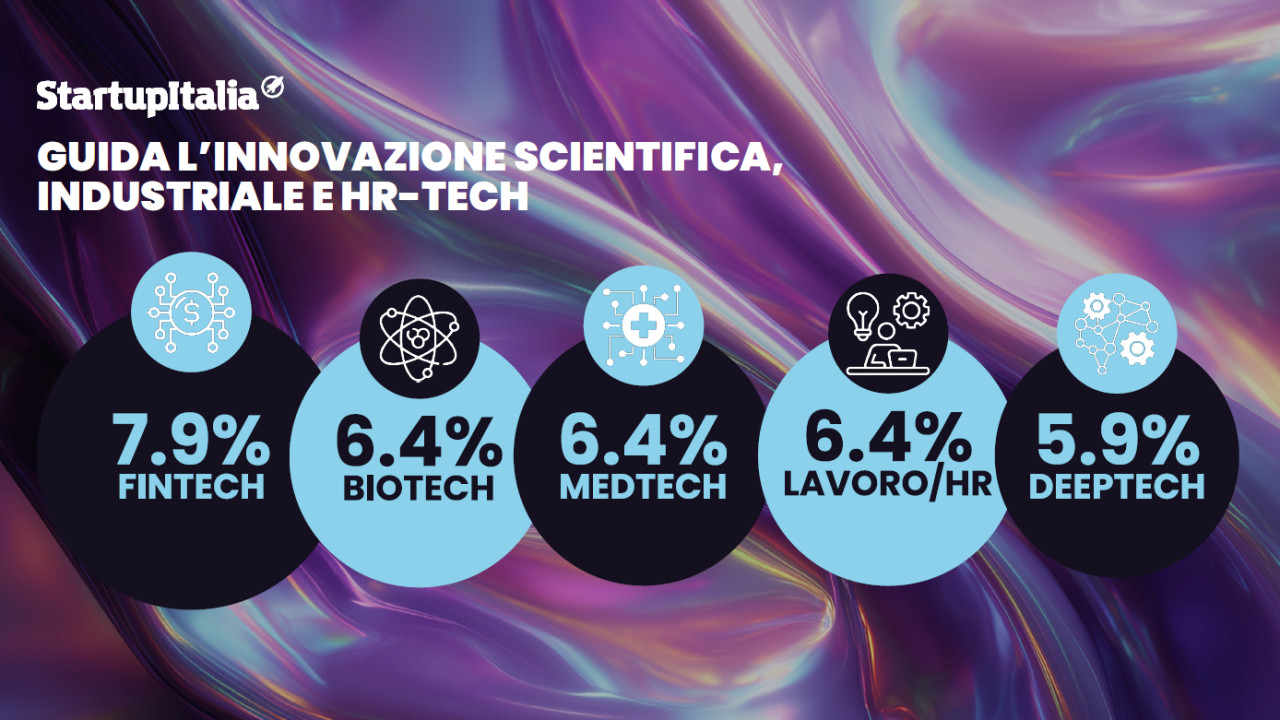

The data indicate a highly polarized market, with a few large transactions absorbing most of the capital. Mid-stage startups continue to face challenges in scaling. Major 2025 rounds included AAVantgarde Bio (€122 million), Nanophoria (€83.5 million), Exein (€70 million), and Hercle (€52 million). Most investments targeted fintech, biotech and medtech, HR technologies, and deeptech.

Lombardy maintained its status as Italy’s leading startup hub, accounting for 47.3% of all deals, or 96 out of 204 rounds. Equity crowdfunding fell to €48 million, a decrease of 9.2%.

Internationally, Europe secured approximately €33 billion in funding during the first nine months of 2025, a 7% increase year on year. Italy remains a minor player, partly due to limited exits, with only 23 transactions in the same period, compared to $177 billion in the United States.

Speakers at SIOS25 Winter cautioned that without stronger ecosystem coordination, bolder policies, and increased investment in the scale-up phase, Italy risks structural stagnation and falling further behind Europe’s leading innovation hubs.

The full report, with details on all 204 funding rounds in 2025, is available online.